[ad_1]

After a strong December 2021 performance, there was a sight decline in jewellery sales in January revealing a new pattern of consumer behaviour leaning towards value and suitability rather than cost.

The latest Retail Edge report for 1 to 31 January, showed that overall sales dollars declined by 1.6 per cent compared with January 2021 but showed a relatively strong increase by 19 per cent when measured against January 2020.

Comparative units sold decreased by 10 per cent when compared with January 2021 and a similar decline of 10 per cent based on a two-year difference (January 2020).

However, comparative average sales based on inventory have seen an increase by 9 per cent ($201) when compared with January 2021 ($185), which also represented a very significant increase by 32 per cent ($153) based on a two-year difference (January 2020).

According to Mike Dyer, sales manager, Retail Edge the sales figures are “good to note” explaining that “this pattern appears to indicate that consumers are making buying decisions around value and suitability rather than how little [they] can get away with spending”.

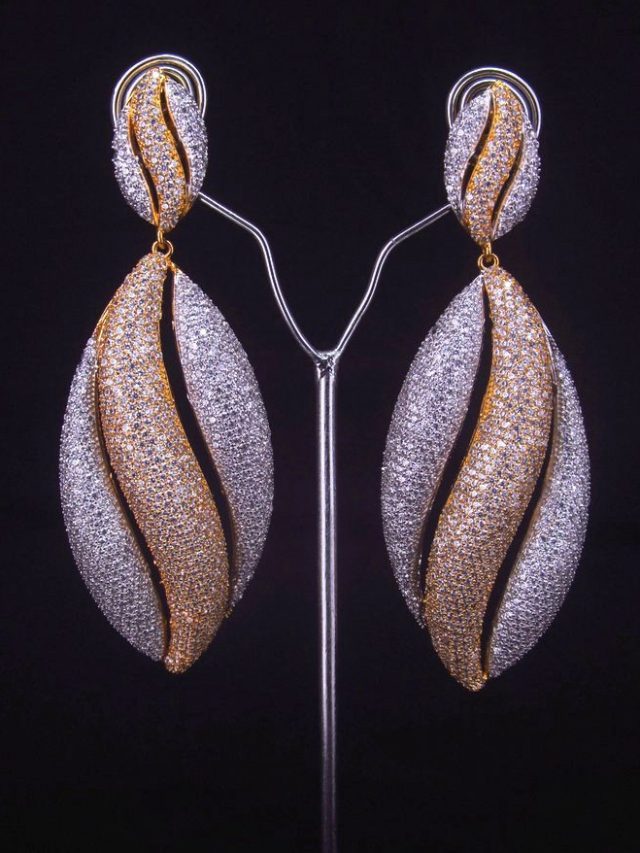

Dyer’s observation is supported by many of the product categories posting an increase in sales dollars, led by diamond set precious metal jewellery which was up by 7 per cent compared with January 2021 and a significant increase of 44 per cent based on a two-year difference (January 2020).

Next in line is silver and alternative metal jewellery with sales dollars up by 5 per cent compared with January 2021, but much higher at 22 per cent when measured against January 2020.

While non-stone metal jewellery sales dollars saw an “insignificant” rise of 0.19 per cent from January 2021, the two-year difference (January 2020) was still “very significant” at 56 per cent.

However, gemstone set precious metal jewellery fell 5 per cent when compared with January 2021 and a 3.1 per cent decline when measured against January 2020.

Despite the sales performance, “all these numbers indicate a reasonably positive consumer buying attitude after a good Christmas trading period,” Dyer said.

Dollars for laybys also declined by 5 per cent between new ones and pickups/cancellations, but services saw an increase by 8.7 per cent and special orders also rose by 9.5 per cent.

“Great to see new work ‘flowing’ into the pipeline,” Dyer added.

Retail Edge’s data is gathered from its POS software across more than 400 Australian independent retail jewellery stores. It is intended to present a representative sample of the wider jewellery industry.

2022 Jewellery Retail Sales January Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Consumer demand for jewellery seen to drive strong December trading

December jewellery sales still upward despite drop in volume

Jewellery sales slump as lockdowns continue; Christmas ‘rebound’ predicted

[ad_2]

Source link