All the world’s a stage, and all the men and women are merely players. It’s time to reflect on the ‘comings and goings’ of Australia’s jewellery industry.

|

It’s been said that ‘change is inevitable, but progress is optional’. The timeless relevance of that statement becomes clear when reflecting on the evolution of the Australian jewellery industry in the past 13 years.

Like all retail categories, jewellers have not been immune to the ups and downs of business cycles, and since 2010, many chain stores have ‘meet thy maker’.

The good news is that there is a great deal of young blood and new faces, as many smaller businesses emerged to breathe fresh life into the fine jewellery and fashion jewellery categories, with several jewellers expanding to ‘chain store’ status.

Jeweller defines a ‘chain store’ as a group of five or more fine or fashion jewellery stores trading under a single (brand) name, with one ownership entity – either person or company – coordinating buying and marketing activities across the group.

This could include a franchise operation.

Births: New kids on the block

Simon Curwood Jewellers is an example of the steady development of a retail business into a new chain.

|

TABLE 2: DEATHS – GONE BUT NOT FORGOTTEN |

|

| Seven chains with 451 stores in 2010 no longer operate in 2023. *Emma & Roe: launched in 2014, and by 2018, had 36 stores that were closed. |

While the family behind the retailer has been involved in the jewellery industry since the 1970s, Simon Curwood Jewellers has now evolved into a jewellery chain and expanded to 14 locations in four states.

The Queensland retailer Mystique Jewellers, with five stores, is another example of an up-and-coming fine jewellery business that has evolved and expanded to ‘chain’ status and are worth watching.

The emergence of these businesses is in line with overall industry trends, as the total number of chain stores has increased by approximately 20 per cent despite a sharply contrasting decline in independent stores.

The fashion jewellery category has also witnessed emerging chains such as Fuse Silver, FinerRings, Zohar, Silver Shop, and Dinosaur Designs since our 2010 study.

Deaths: Gone but not forgotten

Indeed, death is one of life’s greatest mysteries. It’s as inevitable as the sun rising, yet we seem left with more questions than answers when it occurs.

Why does a business die?

Depending on whom you ask, there are many answers. On the surface, it may be as simple as costs exceeding revenue.

However, in some cases, it can be more complex, as many businesses in the Australian jewellery industry have learned.

The past decade’s most profound ‘deaths’ have occurred among fashion jewellery chains.

In 2010, Jeweller recorded seven fashion jewellery chains accounting for 378 stores; however, just one of those chains remains today; six eventually failed.

|

TABLE 1: BIRTHS – NEW KIDS ON THE BLOCK |

|

| While some chains close and/or fail, other chains emerge. Six jewellery businesses now qualify as chains (five stores or more). |

While Lovisa seems to have moved from strength to strength – climbing from 35 stores in 2010 to 175 today – Diva, Equip Accessories, Magnolia Silver, Butterfly Silver, Bijoux and Myka collectively closed more than 340 stores before the end of 2020.

At the time of the 2010 report, Diva was Australia’s largest fashion chain, operating a network of 176 stores.

The company was launched in 2003 by Mark and Colette Hayman, expanding rapidly before being sold to BB Retail Capital in 2005.

Under BB Retail Capital, the chain would peak at more than 500 stores internationally; however, it eventually entered liquidation in 2015.

Budget jewellery chain Kleins was a leading industry figure in 2007 with more than 180 stores; however, the company was in liquidation by May of the following year.

The franchise group collapsed, owing around $25 million, with $15 million owed to secured creditors.

On a case-by-case basis, the forces leading to the detonation of each collapse vary; however, these chains also faced overlapping pressures.

Fashion jewellery is more suited to internet sales because of its high-volume but low-average selling price, and, as a result, competition from established online businesses and emerging ‘progressive’ rivals is fierce.

The business model of these chains has also been challenged by consistent increases in shopping centre tenancy costs. The average rent cost per square metre can far outweigh those on the ‘high street’ and which further reduces profit.

Over the past decade, failure hasn’t been confined to fashion chains – fine jewellery chains have likewise experienced disappointment.

|

| More than 38 per cent of retailers suggested that they are likely to – or are at least considering – retiring or selling their business in the next five years. |

Michael Hill International (MHI) began exploring other markets in 2014 by launching a new jewellery brand and its first concept store – Emma & Roe.

The business drew its name from Michael Hill’s daughter, Emma, and his wife’s maiden name, Roe. The launch occurred after an 18-month trial in five Queensland stores under the Captured Moments brand.

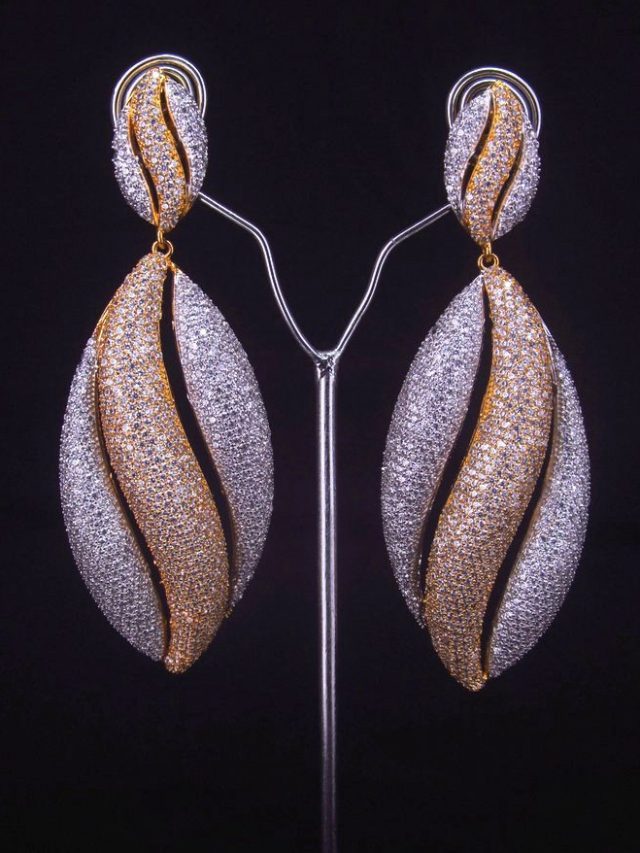

It specialised in a range of charms, bracelets, necklaces, earrings, and stackable rings.

After receiving ‘encouraging results’, the company opened its first Emma & Roe concept store in Mackay (Queensland) in April 2014. Only four years later, the business had failed.

In March 2018, MHI announced it would close 24 of its 30 Emma & Roe stores to ‘refocus the direction’ of the brand.

According to the company, the 24 Australian and New Zealand stores would be closed by 30 June 2018.

The remaining six stores would be repositioned to take on the ‘demi-fine jewellery’ market in smaller, concentrated locations.

However, the brand’s final death certificate was signed only two months later, with the six remaining Emma & Roe stores closed in July 2018.

In a company statement, the closure was attributed to a strategic review, with CEO Phil Taylor announcing that in the future, there would be a “singular focus on the Michael Hill brand.”

“Management resources and capital that would have been required to reposition the Emma & Roe brand will instead be directed to our core business, Michael Hill,” he stated.

Meanwhile, among the fine jewellery chains featured in our 2010 study, Blue Spirit (six stores) and Thomas Jewellers (nine stores) each closed their respective brick-and-mortar locations before the pandemic.

At the same time, several other businesses have fallen under the requisite number of stores to qualify as a chain – Regency, Goldsmith, Pascoe, Dia Oro, Graham’s, and Anthony’s being prominent examples – however, these former chains have continued trading.

Another notable and spectacular jewellery industry collapse was that of the Brisbane-based technology and diamond tracing company Everledger Australia.

Led by self-described serial entrepreneur Leanne Kemp, the company was placed in liquidation with unsecured creditors totalling more than $19 million.

Kemp attempted to save the business after it was under voluntary administration; however, a long list of controversies surrounding her previous business practices and failed ventures became public.

The company’s UK-based parent, Foreverhold Limited, was placed into liquidation in May 2023, while the Australian business suffered the same fate two months later.

Marriages: Two becomes one

MHI delivered the most unexpected story of 2023 when, in April, it confirmed the acquisition of retail rival Bevilles.

As soon as the ink had dried on a $45 million deal, MHI assumed control of 26 stores in Victoria, NSW, and SA and announced plans to open 80 new Bevilles locations by 2028, including expansion into Canada and New Zealand.

|

| While suppliers are less inclined than retailers to retire or sell their business in the next five years, a significant amount (28 per cent) suggested that it was likely. |

At the time, MHI CEO Daniel Bracken said that the strength of Bevilles in gold and silver products would complement the company’s reputation for diamond jewellery – with this new marriage intended to create a more ‘well-rounded’ offering to consumers.

“It has a completely different product proposition to the MHI business and is predominantly focused on gold, silver, and watches, whereas MHI is predominantly diamonds,” he told The Australian Financial Review.

“The majority of Bevilles pricing sits below $500. We’ve stepped away from the mid-market, but we see that there’s still a big opportunity at that end

of the market.”

It is worth noting that in 2010, MHI operated 140 stores in Australia, while Bevilles held 29.

Over the next 13 years, the two companies would head in opposite directions in terms of retail success.

Bevilles entered voluntary administration in April 2014, with a proposed business restructure presented to creditors.

It was the first significant jewellery retailer to fail in 18 years. The Melbourne-based company had incurred trading losses of more than $10 million over the previous three years, and total claims against it amounted to $14 million.

Bevilles would survive an eventual restructuring and retain control of 16 existing stores; however, three years later, a 49 per cent stake in the company was sold to India’s Tara Jewels.

Conversely, MHI’s store count reached 156 in 2020 before declining to 141 during the COVID-19 pandemic.

While the company’s store count has fallen compared to 2010, it’s said that the best revenge is ‘living well’; on the surface, this philosophy applies to the 44-year-old company.

Despite the impact of the pandemic, Michael Hill has reported record revenue in recent years, including $628 million in 2022.

The company has also continued to expand in New Zealand and Canada. Its acquisition of Bevilles was financed by a three-year, $90 million credit facility from ANZ and HSBC.

READ FULL 2024 STATE OF THE INDUSTRY REPORT

Hover over eMag and click cloud to download eMag PDF